Which means that it may be 100 or 50 of the donation made. Taxes please keep your email donation receipt as your official record.

Get Our Sample Of Dividend Payment Voucher Template For Free Dividend Value Investing Payment

To claim a donation as a deduction on your US.

. The fair market value can be deducted against up to 30 of your adjusted gross income and any excess deductions can be carried forward into as many as five additional tax years. Cooperative Baptist Fellowship is a 501c3 tax-exempt organization and your donation is tax-deductible within the guidelines of US. As of December 26 Tzu Chi volunteers had worked more than 8800 shifts to extend care and aid to over 38000 recipients.

To move stock from your brokerage to ours please give the broker our name and account number. Under section 80U of Income. Well send it to you upon successful completion of your donation.

Finally list down the employees details for the current month. NAMI National is a 501c3 tax-exempt organization and your donation is tax-deductible within the guidelines of US. Since this donation is limited to 10 of his aggregate income he can claim RM6000 10 x RM60000 in tax deductions.

Start-up expenses are generally deductible expenses when determining taxable income. Know about income tax deduction and exemptions in India. May take a tax deduction up to the smaller of the actual disbursement for the entertainment expense or JPY 8 million.

Donation made to designated public purpose companies. Acquired goodwill is amortisable for tax purposes over its economic life up to a maximum of ten years. If you are an account holder of Indian banks and have debitcredit cards issued by Indian banks then please select Indian Donors as your donation mode.

If you missed claiming a tax deduction or credit youll need documentation to support the new deduction youre claiming such as a receipt for a charitable donation new or amended Form 1098 Mortgage Interest Statement or Form 1098-T to claim an education credit. Malaysia offers a wide range of tax incentives for the promotion of investments in selected industry sectors which include the traditional manufacturing and agricultural sectors as well as other sectors such as those involved in Islamic financial services ICT education tourism healthcare as well as research and development. Deduction on House Rent Paid.

Well send it to you upon successful completion of your donation. Taxes please keep your email donation receipt as your official record. PCB is deducted from the employees taxable income only.

Without verification we are unable to issue a thank you letter and tax receipt for your gift. Consequently the Tax Court held that the taxpayer was not entitled to the charitable contribution deduction. Income Tax Exemption for FY 2019-2020.

GBMC - Greater Baltimore Medical Center is a 501c3 tax-exempt organization and your donation is tax-deductible within the guidelines of US. When any type of property worth 5000 or more is donated you must obtain a qualified appraisal of the property and must complete Form 8283 Section B and attach it to your tax return. Under section 80RRB the tax deduction is applicable on the income earned by way of royalties and patents.

The interest paid on education loan in the country comes under the section 80E of the tax deduction. You receive a charitable income tax deduction equal to the fair market value of the securities if they have been held longer than one year. Identify the Terms Conditions for PCB Calculation Where to deduct the PCB amount from.

Select Wire Transfer mode if you want to make account to account transfer in IndiaAbroad Avail tax exemption under Section 80G. You will be granted a rebate of RM400. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021.

To claim a donation as a deduction on your US. Getting A Tax DeductionTax Incentive For Your Company. To claim a donation as a deduction on your US.

Tzu Chi volunteers immediately launched flood relief operations including delivering hot meals and daily necessities and helping with the clean-up post flood. Consequently the limit for the total deduction for low-value assets per fiscal year was raised accordingly to EUR 3600. Tax relief deduction.

With regard to expenses for eating and drinking a company. This tax rebate is why most Malaysia n fresh. Taxes please keep your email donation receipt as your official record.

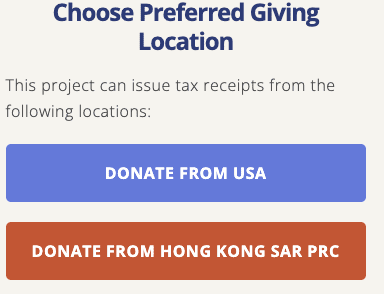

If your chargeable income does not exceed RM 35000 after the tax reliefs and deductions. Read of income tax sections like section 80C 80CCD and other. World Vision Hong Kong is a Christian humanitarian organisation working to create lasting change in the lives of children families and communities living in poverty.

Yes there is a tax deduction for employers in Malaysia subjected to the terms and conditions set by the LHDN. Thus his chargeable income after taking the tax deduction for his donation into account is RM60000 RM6000 RM54000 thus lowering the amount of tax he has to pay. You would be provided with 50 tax deduction certificate for this donation.

Many parts of Malaysia were inundated in mid-December 2021. Hiring disabled worker - Employers are eligible for tax deduction under Public Ruling No. Tax rebate for Self.

I The ASK is for 232 meals per child for an academic year. 32019 of Inland Revenue Board of Malaysia. Lets talk about the deduction for charitable contributions the Internal Revenue Code requires that for you to be able to deduct charitable contributions that several rules be met the primary rule is that the charity must be an approved IRS charity to be an approved IRS charity that of course means it must be US based and it must be formally approved meaning for example if you give.

General donation 025 of capital plus capital surplus 25 of income x 14. The case is Albrecht v. The list goes as follows.

For the patent registered under the patent act1970 up to the amount of Rs300000 income tax can be saved.

Tax Benefits For International Giving Give2asia

Permanent Temporary Differences That Occur In Tax Accounting

Preparing For Annual Tax Reconciliation In China In 2021 Faqs

Pin By Ammy On Attitude Is Mah Beautyy Funny Study Quotes Jokes Quotes Fun Quotes Funny

Download Tax Deductible Donations

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

Important Things In Your Payslips Need To Check Payroll Template National Insurance Number Payroll Software

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Malaysia Travel Guide For Indian By Indian Best Things To Do Malaysia Travel Guide Malaysia Travel Travel Blog

Are Stair Lifts Tax Deductible Medical Tax Stannah

If You Have A Home Loan Which Tax Regime Should You Choose

Updated Guide On Donations And Gifts Tax Deductions

Tax Benefits For International Giving Give2asia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

13 Tips For Making Your Charitable Donation Tax Deductible In 2017

Tax On Resp Withdrawal Lower The Tax Maximize The Benefit Manulife Investment Management

- streak plate method lab report

- cheque deposit cimb

- nama perawi hadis sahih

- faculty of medicine upm

- ubat cepatkan rambut panjang

- contoh surat minta cuti

- angka giliran

- aktiviti sains sekolah rendah

- lampu sorot led besar

- baby food malaysia

- nama anak lelaki dalam islam bermula huruf a

- labu masak lemak lada hitam

- dan tumis bawang putih dan bawang merah sehingga terbit bau

- gambar hitam putih hari guru

- sambal tumis nasi lemak

- muzik muzik 31 2016

- air daun betik untuk denggi

- iklan rumah sewa

- bilik sewa ayer keroh

- mr diy midvalley